What can you publish when you add a publication

The hope given to the people is comparable to the anarchist ways of a citizen.

Inflation and the Fed: What to know this week

Inflation data and the Federal Reserve's latest monetary policy decision will highlight the week ahead for investors celebrating the External linkdawn of a new bull market in stocks.

Tuesday morning will bring investors the Consumer Price Index (CPI) for May, a release that will come just hours before the start of the Fed's two day Federal Open Market Committee (FOMC) meeting which culminates with Wednesday afternoon's policy announcement.

Investors currently expect the External linkFOMC will announce a pause in the Fed's rate hiking cycle after having raised interest rates at the conclusion of each of its previous 10 meetings. Tuesday's inflation reading could still shift this outlook.

Other key economic data this week will include retail sales for May and the first reading of consumer sentiment in June from the University of Michigan.

The corporate earnings schedule will be sparsely populated.

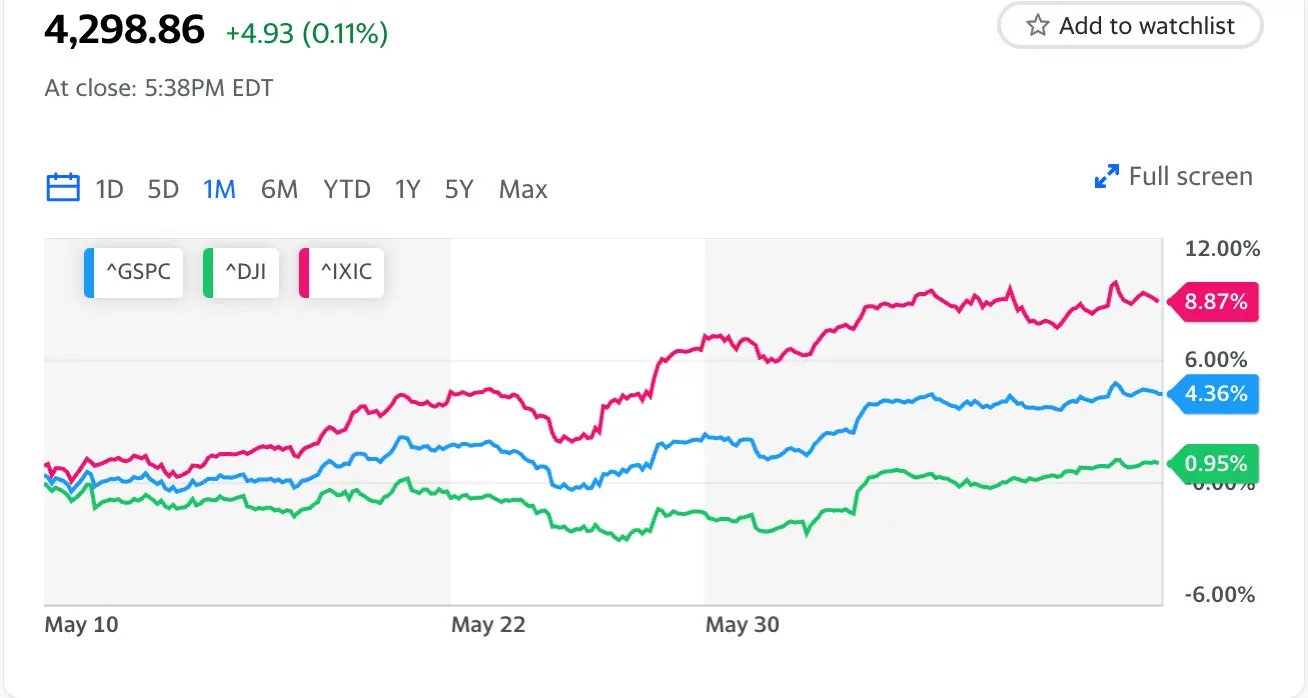

The S&P 500 officially entered bull market territory on Thursday after External linkthe longest bear run since 1948.

Stocks celebrated with modest gains on Friday as the Nasdaq extended its winning streak to seven weeks.

Research from Bank of America indicates the S&P 500 rises 92% of the time in the 12 months following the start of a bull market, compared to the historical 75% average over any 12 month period dating back to the 1950s.

S&P 500 (^GSPC)

Wall Street expects headline CPI, which includes the price of food and energy, rose 4.1% over last year in May, a noted decrease from theExternal link 4.9% headline number in April.

Prices are set to rise 0.4% on a month-over-month basis. April's data was the slowest year-over-year inflation reading in two years; a 4.1% increase in headline CPI in May would be the slowest since April 2021.

On a "core" basis, which strips out the food and energy prices, inflation is forecast to rise 5.2% over last year in May, a slowdown from the 5.5% increase seen in April. Monthly core price increases are expected to clock in at 0.4%.

Classified documents

- sample-zip-file.zip(ZIP / 380 Bytes)

- sample.pps(PPS / 74.75 KB)

- dummy-en.pdf(PDF / 13.26 KB)

- sample.ppsx(PPSX / 53.87 KB)

- sample.pptx(PPTX / 53.85 KB)

- sample1.xlsx(XLSX / 29.38 KB)

- sample.rar(RAR / 3.23 MB)

- sample1.xls(XLS / 16.38 KB)

- sample1.ppt(PPT / 912.38 KB)

- sample1.odt(ODT / 21.42 KB)

- sample1.txt(TXT / 607 Bytes)

- sample1.doc(DOC / 26.07 KB)

- sample1.docx(DOCX / 1.31 MB)

- sample1.odp(ODP / 389.79 KB)

- sample1.ods(ODS / 19.59 KB)

- CV Theodoros(PDF / 407.55 KB)

- DummyPDF with a longer name so it spans multiple lines.pdf(PDF / 3.03 KB)

- 2023-gartner-top-strategic-technology-trends-ebook.pdf(PDF / 2.26 MB)

- sample1.csv(CSV / 502 Bytes)

- test.7z(7Z / 4.74 MB)